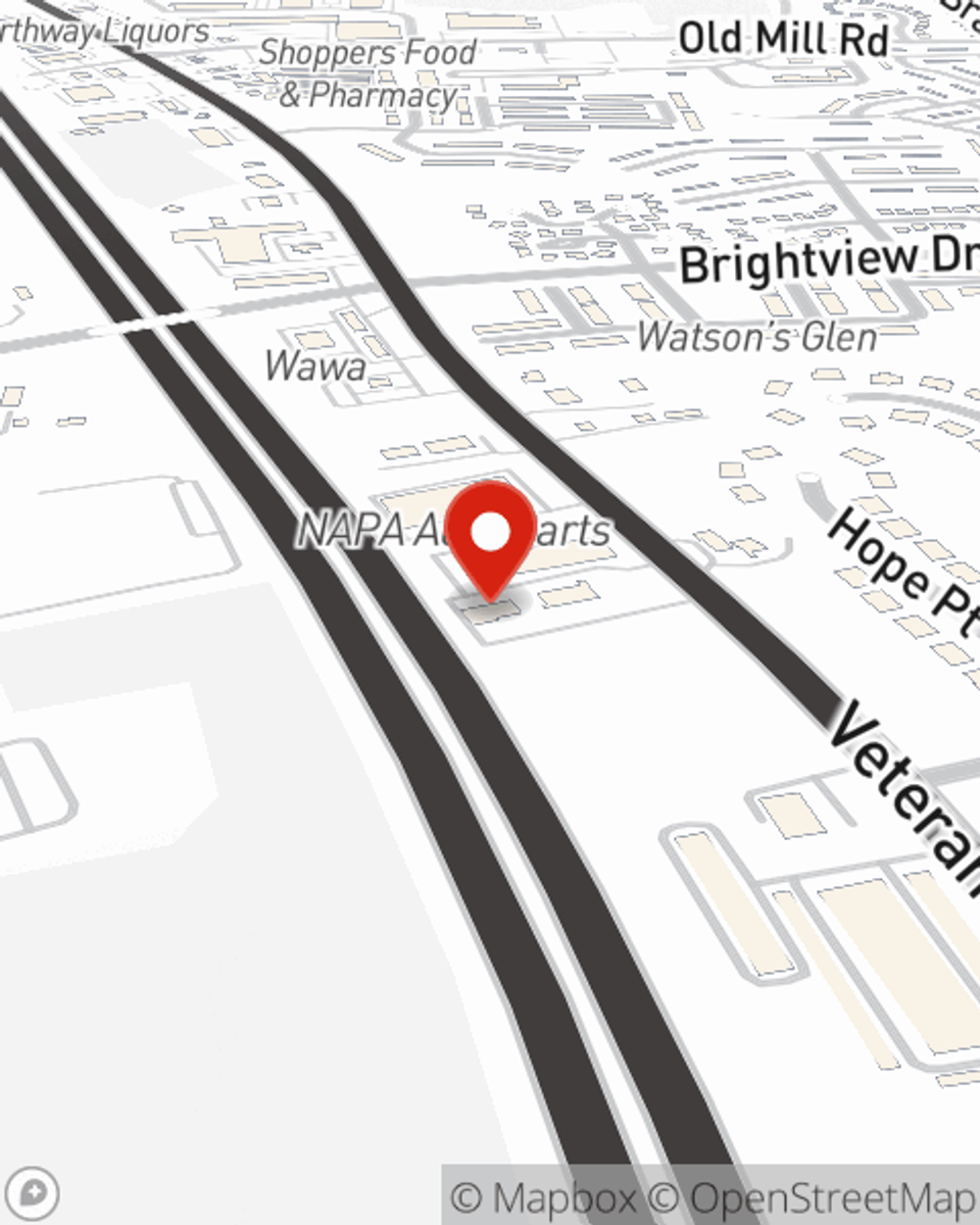

Business Insurance in and around Millersville

Millersville! Look no further for small business insurance.

Almost 100 years of helping small businesses

- Baltimore

- Glen Burnie

- Randellstown

- Bowie

- Millersville

- Richmond

- Lancaster

Business Insurance At A Great Value!

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or problem. And you also want to care for any staff and customers who hurt themselves on your property.

Millersville! Look no further for small business insurance.

Almost 100 years of helping small businesses

Strictly Business With State Farm

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like extra liability or a surety or fidelity bond, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Cliff Johnson can also help you file your claim.

So, take the responsible next step for your business and reach out to State Farm agent Cliff Johnson to explore your small business insurance options!

Simple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Cliff Johnson

State Farm® Insurance AgentSimple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.